The Commercial leasing market is a dynamic arena where businesses find their ideal spaces to thrive. Understanding the intricacies of this market is essential for landlords and tenants alike, as it influences decisions that can significantly impact financial outcomes. From various lease types to the key players involved, this overview sets the stage for a deeper exploration of current trends and challenges in commercial leasing.

As economic conditions shift and technology advances, the commercial leasing landscape continues to evolve. This overview will delve into the essential components of lease agreements, the challenges faced by landlords and tenants, and the opportunities that emerge in this ever-changing market.

Understanding the Commercial Leasing Market

The commercial leasing market plays a crucial role in the business landscape, shaping how companies secure and utilize space for their operations. It encompasses a wide range of properties, from office buildings to retail spaces, and involves various stakeholders, each contributing to the leasing process. A solid grasp of the principles and players in this market can aid businesses in making informed decisions.Fundamental principles of commercial leasing are built on the types of leases available, each serving distinct functions tailored to the needs of landlords and tenants.

The primary types of commercial leases include:

Types of Commercial Leases

A clear understanding of lease types is essential for navigating the commercial leasing market. The main types include:

- Gross Lease: The landlord covers all operating expenses, simplifying costs for tenants.

- Net Lease: Tenants pay base rent plus a portion of operating expenses, which can be further classified into single, double, and triple net leases, depending on the expenses included.

- Percentage Lease: Mainly used in retail, this lease bases rent on a percentage of the tenant’s sales, aligning interests between the landlord and tenant.

- Modified Gross Lease: A blend of gross and net leases, where some operating expenses are shared between the landlord and tenant.

Each lease type serves specific needs, influencing the overall financial dynamics between parties involved. Key players in the commercial leasing market include landlords, tenants, and real estate brokers, each playing a pivotal role in transactions. An understanding of their functions is vital for successful leasing agreements.

Key Players in Commercial Leasing

Recognizing the roles of the key players can enhance collaboration and negotiation in leasing agreements. The players include:

- Landlords: Property owners who seek to lease their spaces for profit, often managing multiple properties.

- Tenants: Businesses or individuals leasing space for operational purposes, seeking favorable terms to support growth.

- Real Estate Brokers: Professionals who facilitate transactions, offering market insights and aiding in negotiations between landlords and tenants.

Each player brings unique perspectives and goals to the table, impacting lease terms and conditions.Current trends in the commercial leasing market are largely influenced by economic conditions and technological advancements. Understanding these trends can help stakeholders adapt their strategies effectively.

Current Trends in the Commercial Leasing Market

Several trends are shaping the commercial leasing landscape, driven by evolving market dynamics and technological innovations. Key trends include:

- Remote Work Influence: The rise of remote and hybrid work models has led to reduced demand for traditional office space, prompting landlords to rethink lease structures.

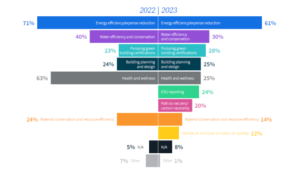

- Sustainability Initiatives: Tenants increasingly prefer energy-efficient buildings, driving landlords to invest in sustainable practices and certifications.

- Technological Integration: Advancements in property technology (PropTech) are enhancing the leasing process, with tools for virtual tours and digital lease signing becoming commonplace.

- Flexible Lease Options: The demand for short-term leases and co-working spaces is growing, allowing businesses to adapt to changing needs without long-term commitments.

With these trends in mind, both landlords and tenants can navigate the commercial leasing market more effectively, positioning themselves for success in a rapidly changing environment.

“The commercial leasing market is dynamic, constantly evolving with economic and technological shifts.”

Commercial Lease Agreements

Commercial lease agreements are vital documents that Artikel the terms and conditions of renting commercial properties. These agreements not only protect the interests of landlords but also ensure that tenants have a clear understanding of their rights and responsibilities. An effective lease agreement can foster a positive relationship between both parties and contribute to a successful business operation.

The essential components of commercial lease agreements include the lease term, rental rate, security deposit, maintenance obligations, and permitted use of the property. Each of these elements plays a crucial role in defining the relationship between the landlord and tenant. Clarity in these components can help prevent future disputes and misunderstandings.

Types of Commercial Leases

Understanding the various types of commercial leases available is crucial for both tenants and landlords. Each lease type has distinct implications regarding costs and responsibilities. Here are the primary types of commercial leases:

- Gross Lease: In a gross lease, the landlord covers all property expenses, including taxes, insurance, and maintenance. The tenant pays a flat rental fee. This type of lease is beneficial for tenants as their total rental cost remains predictable.

- Net Lease: A net lease requires the tenant to pay base rent plus some or all property expenses. There are several variations:

- Single Net Lease (N): The tenant pays base rent plus property taxes.

- Double Net Lease (NN): The tenant pays base rent, property taxes, and insurance.

- Triple Net Lease (NNN): The tenant covers base rent, taxes, insurance, and maintenance costs. This lease type shifts most financial responsibilities to the tenant.

- Modified Gross Lease: This lease type is a hybrid, where the tenant pays a base rent and a portion of the property expenses, such as utilities and maintenance. The specifics can vary based on negotiations.

Comparison of Lease Terms Across Various Commercial Property Types

Lease terms can differ significantly based on the type of commercial property involved. The following table illustrates the variations in lease conditions for different commercial property types:

| Property Type | Typical Lease Duration | Common Lease Type | Tenant Responsibilities |

|---|---|---|---|

| Office Space | 3-10 years | Modified Gross or Gross Lease | Utilities, janitorial services |

| Retail Space | 3-15 years | Net or Triple Net Lease | Maintenance, property taxes |

| Industrial Space | 5-20 years | Triple Net Lease | All operating costs |

| Warehouse Space | 5-15 years | Net or Modified Gross Lease | Utilities, maintenance |

By understanding the nuances of commercial lease agreements and the different types available, tenants and landlords can make informed decisions that suit their financial and operational needs. Clarity and comprehensive knowledge of lease terms can foster stronger business relationships and smoother transactions in the commercial leasing market.

Challenges and Opportunities in Commercial Leasing

The commercial leasing market presents a unique blend of challenges and opportunities for both landlords and tenants. Landlords often navigate complex hurdles such as vacancies, tenant defaults, and compliance with regulatory frameworks. On the other hand, tenants seek advantageous lease terms amidst a competitive environment. However, the shifting dynamics of this market also unveil new avenues for growth, especially in innovative practices like co-working spaces and sustainable building initiatives.

Challenges Faced by Landlords

Landlords in the commercial leasing sector encounter several significant challenges that can impact their investment returns. These include:

- Vacancies: High vacancy rates can lead to a significant loss of income. In urban centers, economic downturns can increase vacancies as businesses shut down or relocate, leaving landlords with unoccupied spaces.

- Tenant Defaults: The risk of tenants failing to meet their lease obligations is a constant concern. Economic instability can lead to defaults, resulting in costly eviction processes and prolonged periods of vacancy.

- Regulatory Compliance: Keeping up with local, state, and federal regulations can be cumbersome. Landlords must ensure that their properties meet safety standards, zoning laws, and accessibility requirements, which can require significant resources.

Strategies for Tenants to Negotiate Favorable Lease Terms

Tenants can employ various strategies to secure favorable lease agreements that cater to their needs, providing leverage during negotiations. The following practices can enhance their position:

- Research the Market: Understanding current market trends and comparable lease terms can empower tenants during negotiations. This research allows them to justify their requests for reduced rental rates or better terms.

- Leverage Time: Timing can play a critical role; negotiating during slower market periods may yield better terms, as landlords are more inclined to fill vacancies.

- Seek Flexibility: Requesting options for subletting or lease termination can provide tenants with flexibility as their business needs evolve.

Emerging Opportunities in the Commercial Leasing Market

The commercial leasing market is evolving, with new opportunities arising from changing work patterns and environmental concerns. Notable trends include:

- Co-Working Spaces: The rise of remote work has led to increased demand for co-working spaces, which provide flexible arrangements for businesses. For instance, companies like WeWork have redefined office leasing by offering short-term leases and collaborative environments, appealing to freelancers and startups alike.

- Sustainable Building Practices: Sustainability is becoming a priority for both landlords and tenants. Buildings designed with green technologies and energy-efficient systems can attract tenants willing to pay a premium for eco-friendly spaces. A case in point is the Bullitt Center in Seattle, known as the “greenest commercial building,” which incorporates solar energy and rainwater harvesting.

Final Conclusion

In conclusion, the Commercial leasing market presents both challenges and opportunities for all stakeholders involved. As landlords and tenants navigate the complexities of lease agreements and market trends, understanding the fundamental principles and emerging practices can lead to mutually beneficial outcomes. Staying informed and adaptable will be key to thriving in this competitive environment.

Essential FAQs

What are the main types of commercial leases?

The main types of commercial leases include gross leases, net leases, and modified gross leases, each varying in terms of responsibilities for expenses like maintenance and utilities.

How do economic conditions affect the commercial leasing market?

Economic conditions influence demand for commercial space, rental rates, and tenant negotiations, directly impacting the health of the leasing market.

What strategies can tenants use to negotiate better lease terms?

Tenants can negotiate better lease terms by conducting thorough market research, understanding their needs, and being willing to walk away if terms are unfavorable.

What are some emerging trends in commercial leasing?

Emerging trends include the rise of co-working spaces, the incorporation of sustainable practices, and increased reliance on technology for managing properties.

How can landlords address challenges like vacancies and tenant defaults?

Landlords can address these challenges by improving property management, offering competitive rates, and actively marketing their spaces to attract potential tenants.